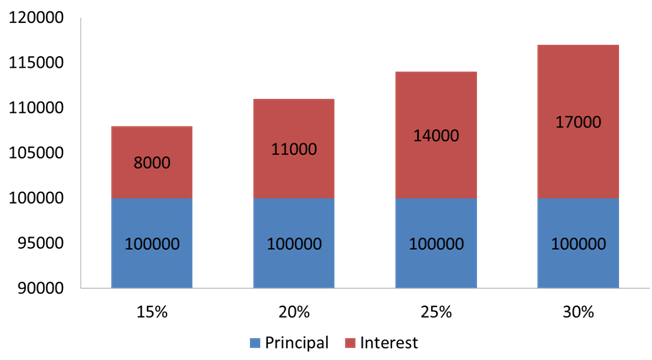

Cost of capital: D 100,000

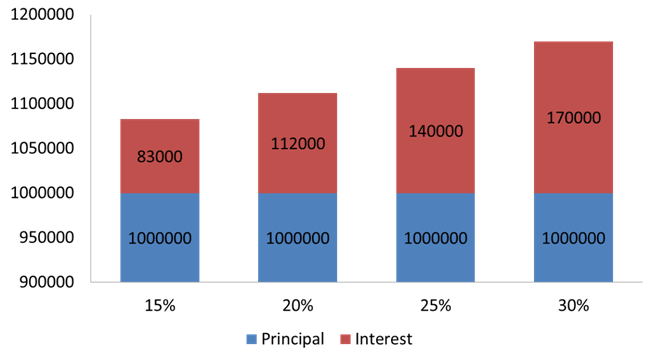

Cost of capital: D 1,000,000

Lenders tend to group borrowers into segments according to their Credit Profile, which includes an overview of assets, debt and history of on-time payments on outstanding loans. Your credit worthiness determines how much interest you'll be charged for your mortgage, student or car loan or the type of credit card you'll be offered.

A strong credit profile can save you thousands over the life of a loan.

For example, a customer with a 30% interest rate on a loan (likely due to a weak credit profile) will pay more

than 100% in additional interest payments than a customer with a 15% interest rate*

*over the life of a loan